This blog's content was taken from episode 253, " 4 Lessons from Buffett's 2022 Shareholder Letter"

You can go check out the whole episode here:

| Spotify | Apple Podcasts | The Canadian Investor Podcast Network |

Here we discuss a quick primer on government bonds. Whether it’s Canadian government bonds or US treasuries.

Understanding the bond market is an important part of investing, particularly when it comes to interest rates. Government bonds, such as Canadian government bonds or US treasuries, are issued to cover government expenses. As these bonds come to maturity, they are typically rolled over, with interest rates affecting the cost of this rollover.

The current federal government debt is around 1.5T (much higher if you include provinces). For the 2021-2022 fiscal year, the government reported revenues over a bit more than 400B. When the bonds are rolled over, the interest cost increases as interest rates rise.

Rising rates could eventually impact the ability of the government to spend as a larger part of its expenses are allocated to pay interest on debt.

When looking at government bonds, you really have to look at it from a duration standpoint because it will tell you different things. Typically, the shorter the duration the lower the yield will be. That’s because when you invest in longer duration bonds, you want to get compensated for the fact that there is more uncertainty and potential for interest rates to go up, therefore having a bigger effect on bonds that have a longer duration. That’s because the longer the timeframe to maturity, the more there will be interest payments remaining on that bond. In turn, that depresses the market value of the existing bond.

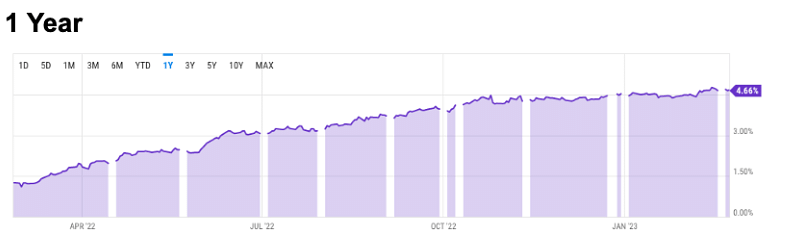

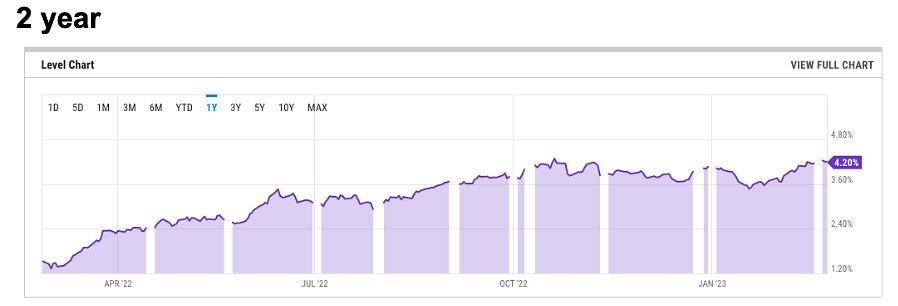

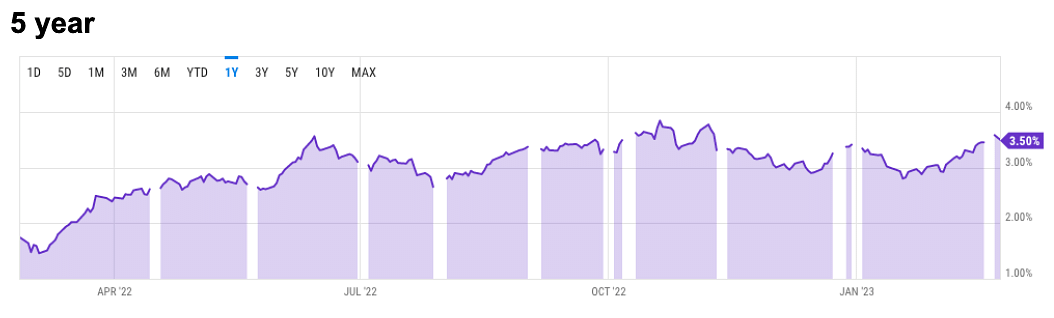

The 3 charts above show interest rates over the last year for the 1 year, 2 year and 5 year Canadian government bond. What you see in those charts is pretty simple.

The 1 year is “smoothish” slow climb to the right almost in lockstep with BOC increases with not many bumps and currently sits at 4.66%. The 2 year has a bit more bumps and is sitting at 4.20%. The 5 year is much more volatile and is sitting at 3.50%. The US 5 year bond is yielding 4.17% for additional context.

To elaborate on the 5 year bond yield:

First thing that we’re seeing is that the yield is lower for the longer duration than shorter duration which is not typical. That’s what is called yield curve inversion.

Second, we’re seeing that the 5 year bond yield bottomed around the end of January just below 3% and sits now at around 3.5%. That’s despite the BOC saying that they would pause rates this year. The market is essentially saying that they think rates will need to stay high longer.

Third, the fact that the US treasury of the same duration is yielding more than 60bps more than the Canadian one is likely to keep putting pressure on the Canadian dollar because it makes the 5 year US treasury more attractive to investors. Even if the rates were the same, there would be more demand for the US treasury since it’s USD is the reserve currency.