This blog's content was taken from episode 259, "Looking at 2 Impressive Under the Radar Companies"

You can go check out the whole episode here:

| Spotify | Apple Podcasts | The Canadian Investor Podcast Network |

Wise

To put it simply, Wise is PayPal without the fees and currency conversion rates. Conversion rates are typically almost identical and go up to 4 decimal places, sometimes even more.

When you take a closer look at Wise you’ll see that they are accomplishing this with over 50 global currencies. Their infrastructure is onto something that isn’t impossible but difficult to replicate.

Wise is a UK listed Fintech company that used to go by the name TransferWise and has a market cap of 5 billion.

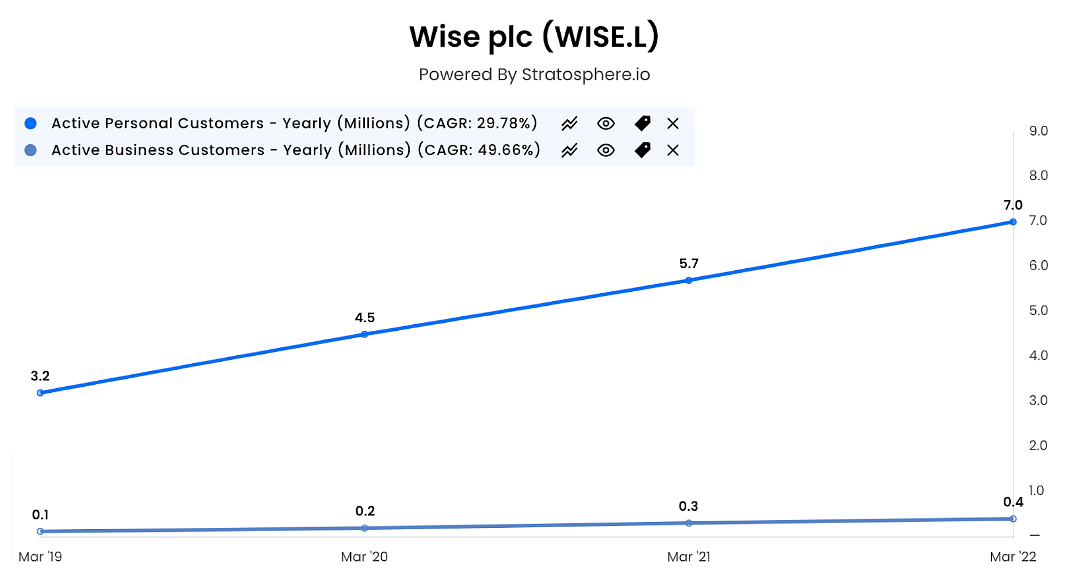

Based on their last annual numbers, you’ll see that the number of personal Wise accounts have gone up from 3.2 million to 7 million. Business customers have gone up from 100, 000 to over 450, 000.

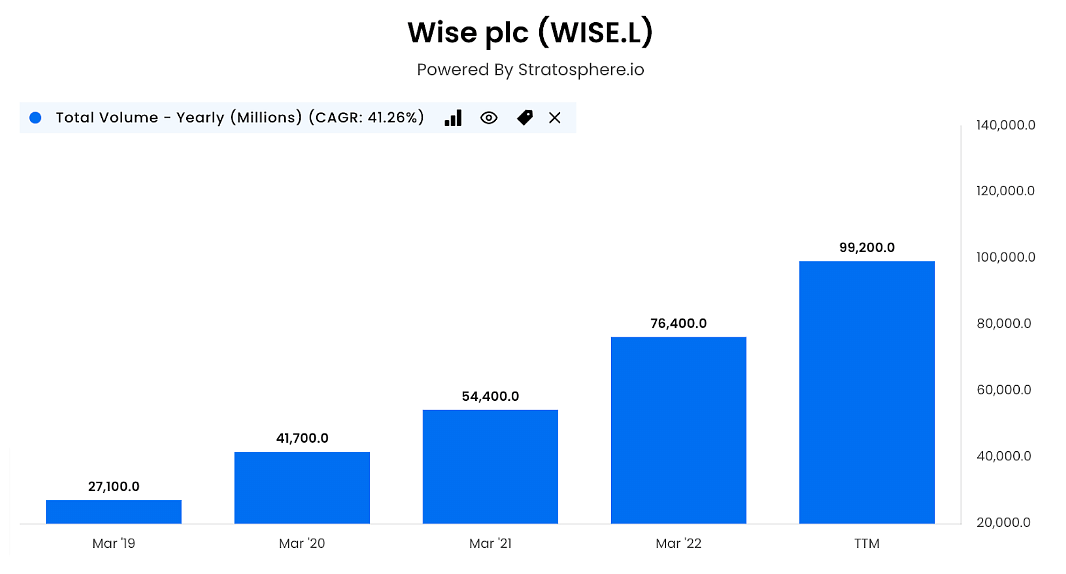

Since March 2019, the total volume of moving money on the platform has gone up from 27.1 billion in USD to 99.2 billion.

While it isn’t a cheap stock, if customer accounts and total volume continue to progress like this it’ll definitely be justified.

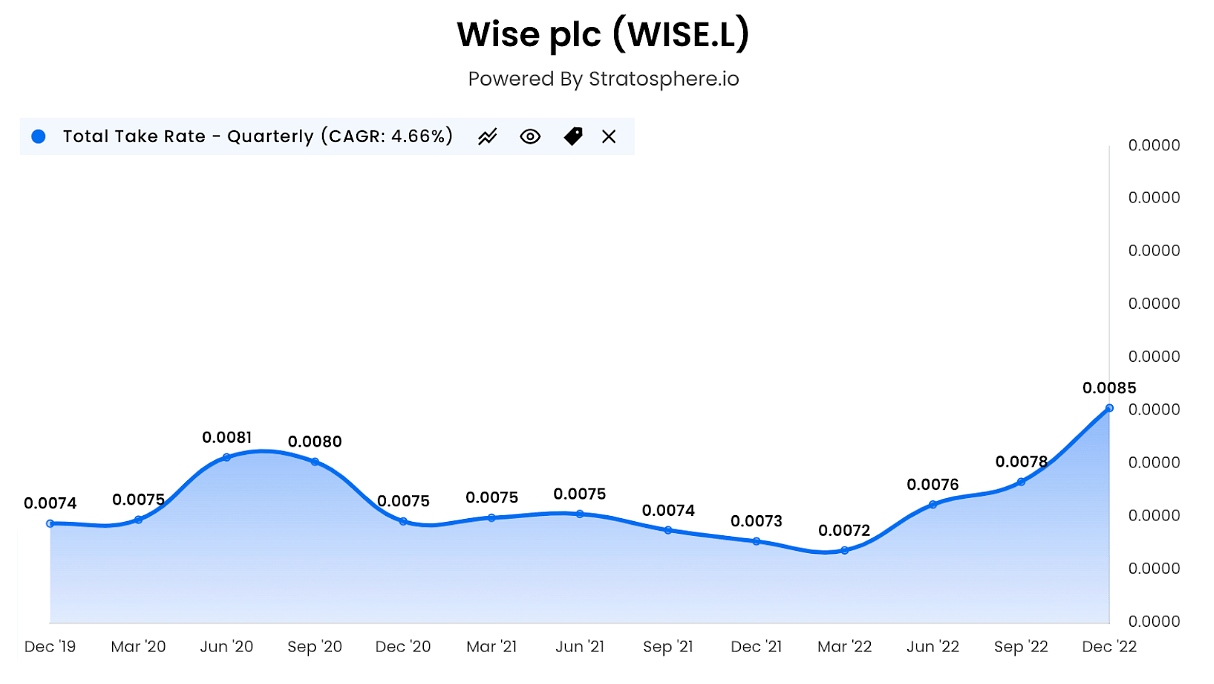

However, there are key risks. Wise has an innovator’s dilemma: a race to zero. The product itself may be better than PayPal but it is a worse business on unit economics because of its mission, just take a look at the rates.

You can take a more detailed look at their KPI on stratosphere.io.

West Pharmaceutical Services (WST)

WST is a leading manufacturer of packaging components and delivery systems for injectable drugs and healthcare products. They have two main segments, the first one is proprietary products and the second one is contract-manufactured products.

The proprietary products segment offers packaging and containment solutions, drug delivery systems, and analytical lab services.

On the other hand, the contract-manufactured products segment focuses on designing and manufacturing complex devices for their pharmaceutical customers.

WST has crushed the S&P 500 and here is a quick overview of the company showing you why:

- Has a market cap of 25 billion

- Has a P/E of 42 and P/FCF of 34

- Revenues have a compound annual growth rate at 12% in the past 5 years

- Has a pristine balance sheet with very little debit and a net cash position

- Pays a dividend that has been steadily increasing over time currently yielding 0.23%

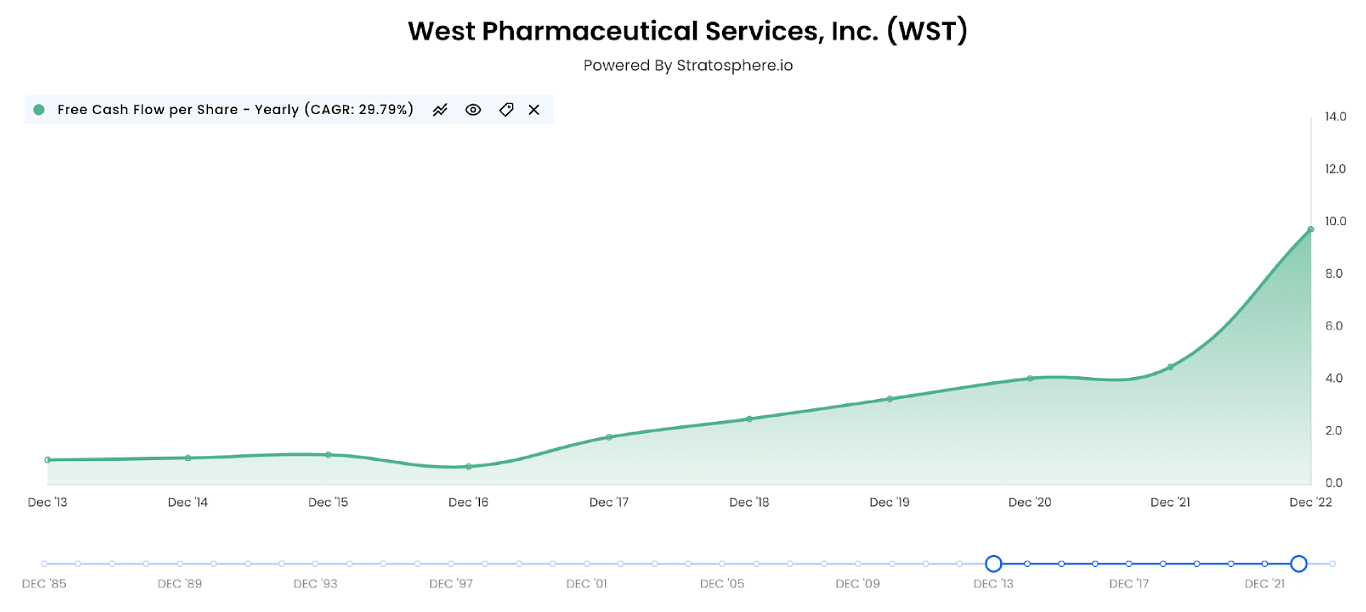

- Free cash flow per share has been steadily increasing over time

You can take a closer look at WST on stratosphere.io as well.