This blog's content was taken from episode 288, " A Recession Proof IPO and Apple Hits 3 Trillion"

You can go check out the whole episode here:

| Spotify | Apple Podcasts | The Canadian Investor Podcast Network |

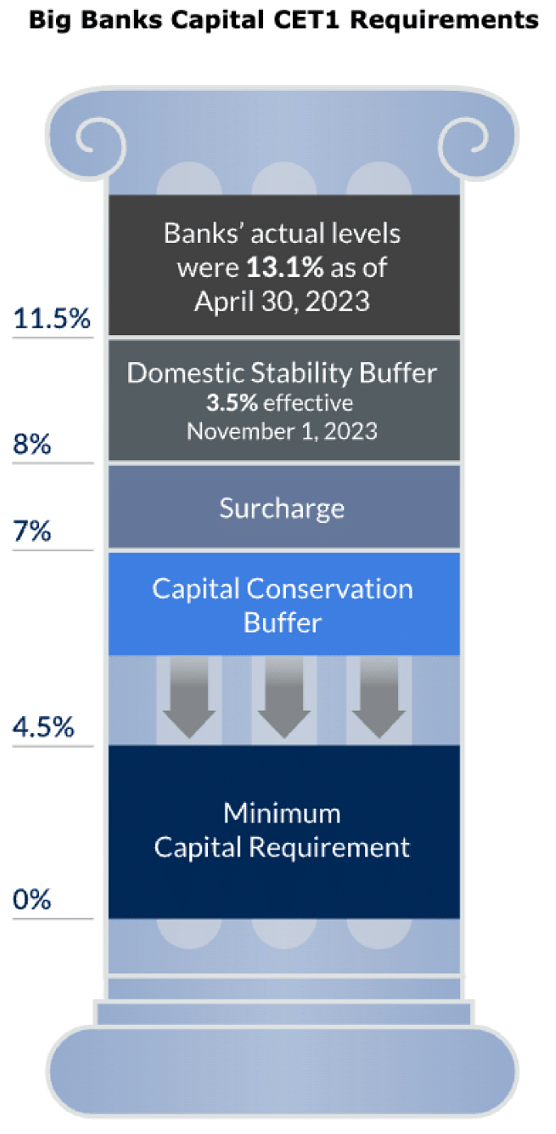

The Office of the Superintendent of Financial Institutions (OSFI) in Canada plays a crucial role in supervising and regulating the country's financial institutions. As part of its ongoing efforts to ensure a stable financial system, OSFI has recently announced an increase in capital requirements for Canada's largest banks. Effective from November 1, 2023, the Domestic Stability Buffer (DSB) will be raised to 3.5% of total risk-weighted assets. It was last increased in February of 2023 from 2.5% to 3%.

They stated the following reasons for doing so:

- Systemic vulnerabilities remain elevated

- High household and corporate debt levels

- Persistent global uncertainty around fiscal and monetary policy

It is important to note that the increased capital requirements are applicable only to Canada's six largest banks; BMO, BNS, CIBC, TD, National Bank, and Royal Bank. These institutions, known as Domestic Systemically Important Banks (D-SIBs), play a significant role in the country's financial landscape.

The Domestic Stability Buffer is a component of the Common Equity Tier 1 Capital (CET1) ratio requirements. In short, this capital requirement is there to fund a financial institution's business activities. It’s a buffer that allows them to absorb unexpected losses. With the recent increase in the DSB, Canada's big banks will now be required to maintain an overall CET1 capital ratio of 11.5%.

For additional context, part of the CET1 ratio that OSFI sets is based on Basel 3 which is an international regulatory framework for banks. This standard was established after the 2007-2008 financial crisis. It requires to have a CET1 ratio of at least 4.5% with higher requirements for D-SIB and G-SIB banks.