This blog's content was taken from episode 259, "Looking at 2 Impressive Under the Radar Companies"

You can go check out the whole episode here:

| Spotify | Apple Podcasts | The Canadian Investor Podcast Network |

What is Irrational Optimism?

Irrational optimism, a characteristic that I believe all of the greatest innovators, thinkers, and investors possess. When their world seems to be falling apart, news is only negative, and they’re facing an extreme uphill battle; the irrational optimists are crazy enough to just do it.

To do amazing things you have to be smart enough to start and dumb enough to think it is going to work.

This is irrational optimism in a nutshell. Just dumb enough to think it is going to work when every rational sign is telling you it won’t.

Just take a look at The Canadian Investor podcast. Most podcasts fail and 90% of podcasts don’t make it past episode 20. We were irrationally optimistic to think that we could pull it off and now we’re looking at 3.5 million listeners this year alone.

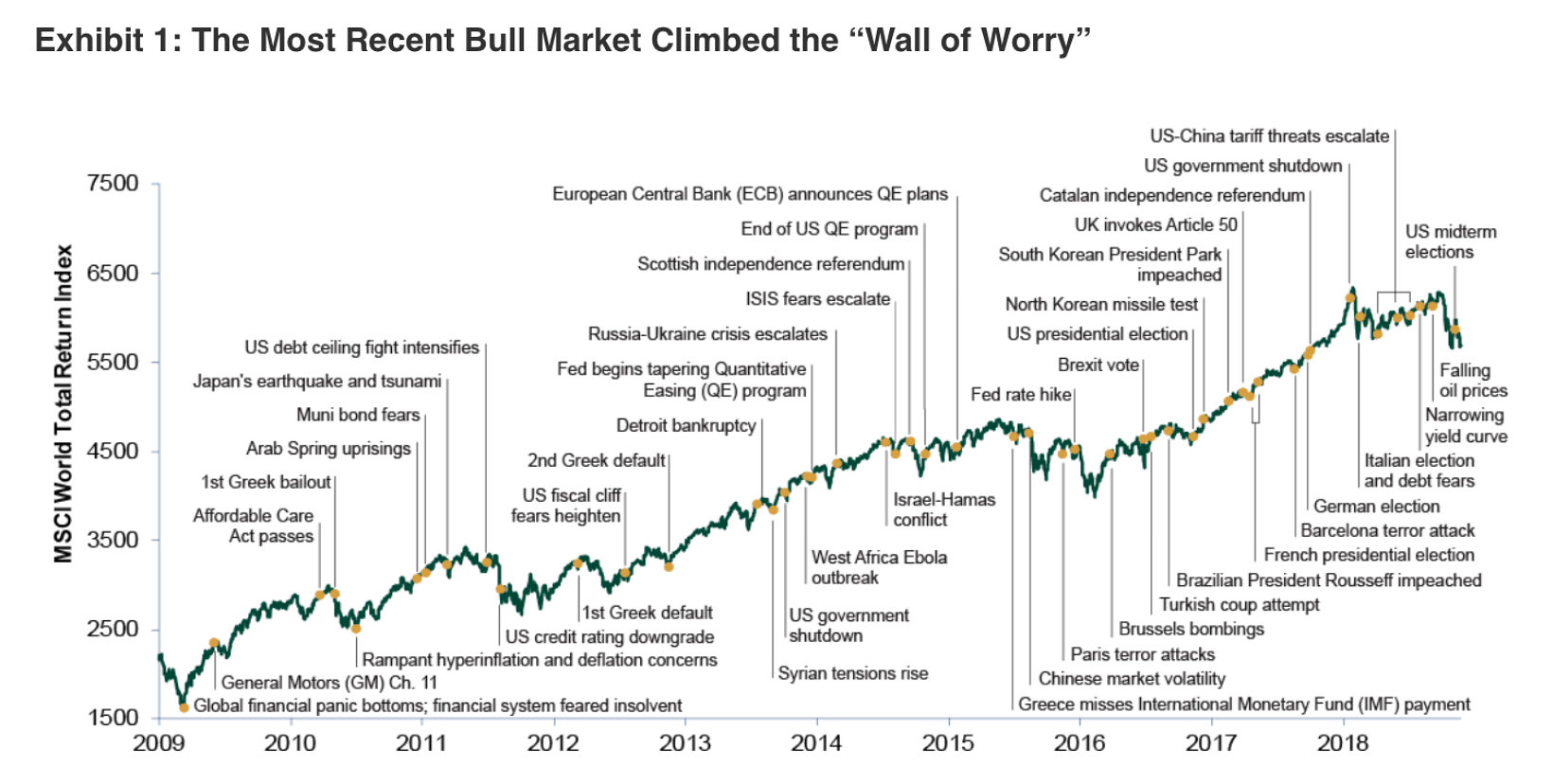

Great investors have this incredible sense of ability and wit but the pessimistic part of their brain turns a blind eye to irrational optimism. This is similar to cautious optimism but much more dramatic. They have the ability to look at the greater picture and say, “sure, it looks bad now but let’s zoom out and look at how far we’ve come in addition to where we’ll go over the long term.”

Iconic Investor and Irrational Optimist: Philip A. Fisher

Let’s contextualize this by taking a look at Philip A. Fisher, the author of an iconic book on investing called Common Stocks and Uncommon Profits. Fisher was known as one of the greatest growth investors and believed in the buy-and-hold investment approach. He believed that you would see long-term growth if you hold great companies for a long time and avoid selling them (unless their fundamentals deteriorate dramatically).

This is an investment strategy that requires supremely optimistic long-term views about a business existing and thriving years down the line.

Philip A. Fisher was born September 8, 1907 and passed away in 2004. Fisher did not have it easy during his lifetime. Here is his wall of worry for context:

- He is a young boy during World War I.

- After the war, the Spanish flu circles the globe for 4 months and claims the lives of more than 21 million people.

- The Great Depression hits with a ruthless recession after the roaring 20s and stocks plummet.

- He is 32 when World War II starts.

- The Stagflation era follows. An era of slow growth, high unemployment rates, and rapid inflation.

- The Vietnam War, Black Monday, and Cold War.

Through it all Fisher wrote books and managed money rooted in the concept of irrational optimism.

Read about what Fisher Investments Canada has to say about the “Wall of Worry” here.

Today in 2023 the negative news cycle is heightened by bad incentive structures generating clicks and incentives. Amidst the worries and pessimism I encourage you to be irrationally optimistic for the markets and innovation people are creating.