This blog's content was taken from episode 261, "Will Bitcoin Get to 1 Million in 90 days"

You can go check out the whole episode here:

| Spotify | Apple Podcasts | The Canadian Investor Podcast Network |

Dividends are a mechanism of returning cash to business shareholders.

Despite contrary belief, dividends are not free money. There is no loophole for free money here. Cash from the business is moving from their pockets into yours, from their balance sheet to yours. Therefore, the value of the business has gone down.

This is why you can’t simply print free money by buying a stock for its ex-dividend date, selling it, and profiting. If only it were that easy.

With that in mind, dividends are very effective. Dividends are very good at completing the mechanism of returning cash to shareholders. Many companies have compounded value while paying a dividend and growing dividend for that matter and have done exceptionally well.

Typically, this is when the business is operating with prudent capital allocation. This is a functional dividend. A dysfunctional dividend flips it on its head.

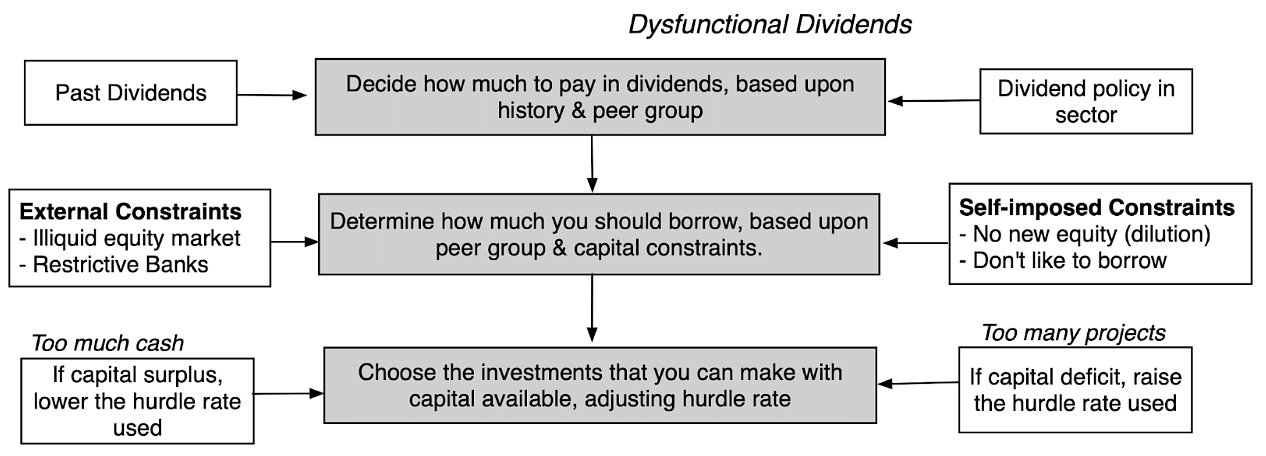

Take a look at this flowchart.

Dividend allocation is at the bottom of the decision tree in a dysfunctional dividend. It is paid based on what has been paid in the past. It could be “we’ve historically been paying a huge dividend” or even “all of our competitors are paying a huge dividend, we should too.” They’re lining up short-term incentives instead of long-term ones.

Algonquin Power is a company that comes to mind. Just look at their financials and dividend policy.

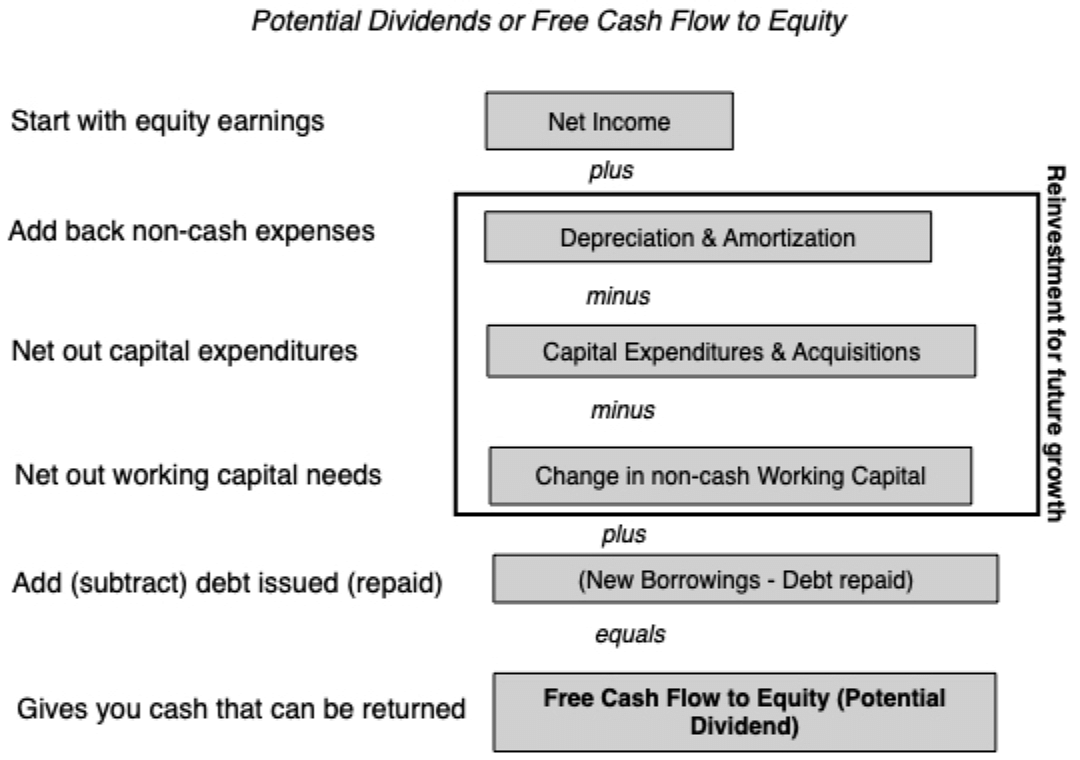

A functional dividend policy looks at the cash the business is generating and reinvests it quickly and effectively in high hurdle rate activities. Reinvesting to compound business value in high expected return activities.

Looking at the flowchart again, a functional dividend policy has dividends paid at the bottom. Companies need to ensure high return activities are allocated, initiatives are evaluated, and the balance sheet is rock solid. Then they can take a step back, look at all of the cash they’re printing, and decide to distribute it to shareholders.

A dysfunctional dividend policy has this flipped. Dividends are served first and based on past dividends and what the industry typically does. This dysfunctional dividend policy is simply the prudent capital allocation decision tree in reverse.

Take a look at this chart. This is how it should be generically:

Mature highly profitable compounders can do both: grow and pay a dividend.