This blog's content was taken from episode 315, "Dividend Stocks Are Getting Crushed" You can go check out the whole episode here:

| Spotify | Apple Podcasts | The Canadian Investor Podcast Network |

You can watch the whole video at join.tci.

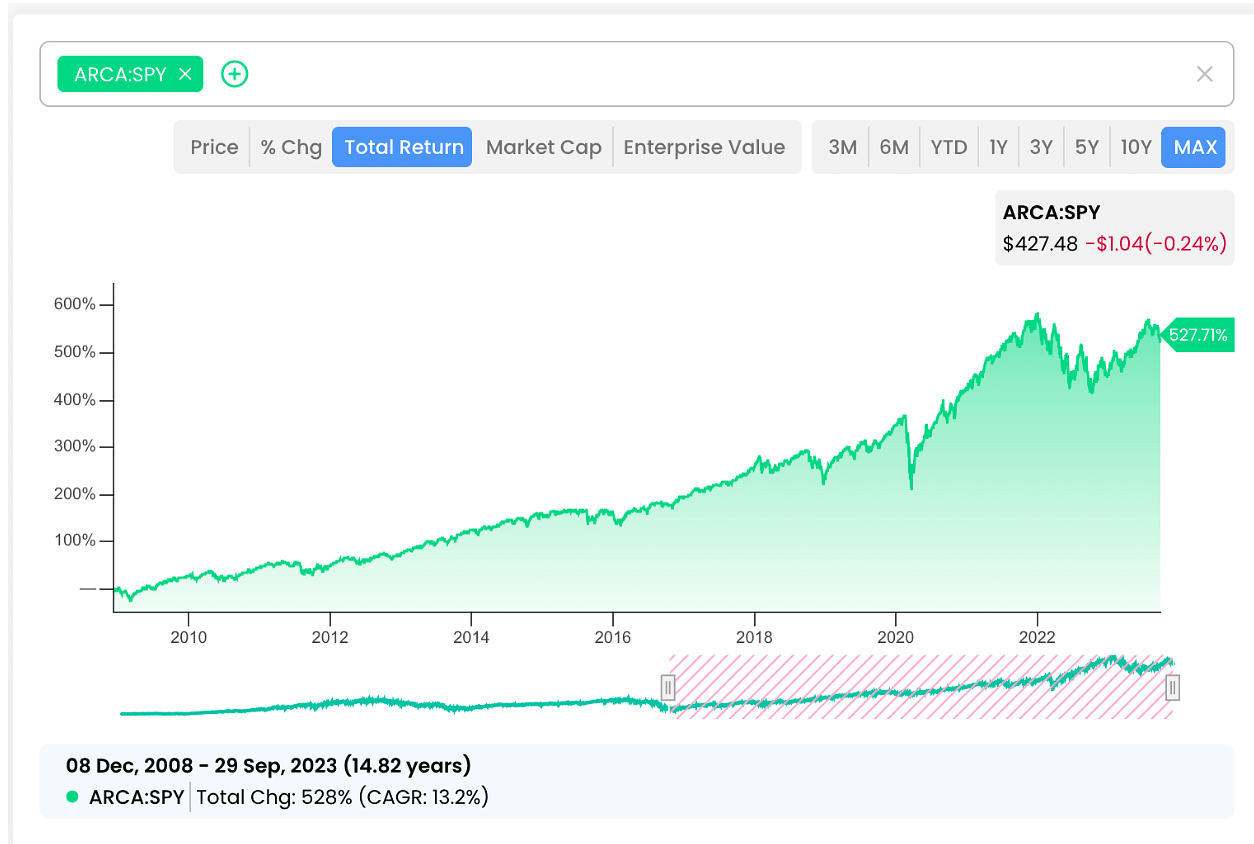

Stocks are said to climb the “wall of worry” - the basic concept is that stocks as an asset class have had excellent long term returns averaging around 10% historically.

If you listen to this podcast you know from frequent reminders that stocks rarely return 10%, usually the markets in calendar years, it's more normal historically to be up big or down big rather than return anywhere near that average.

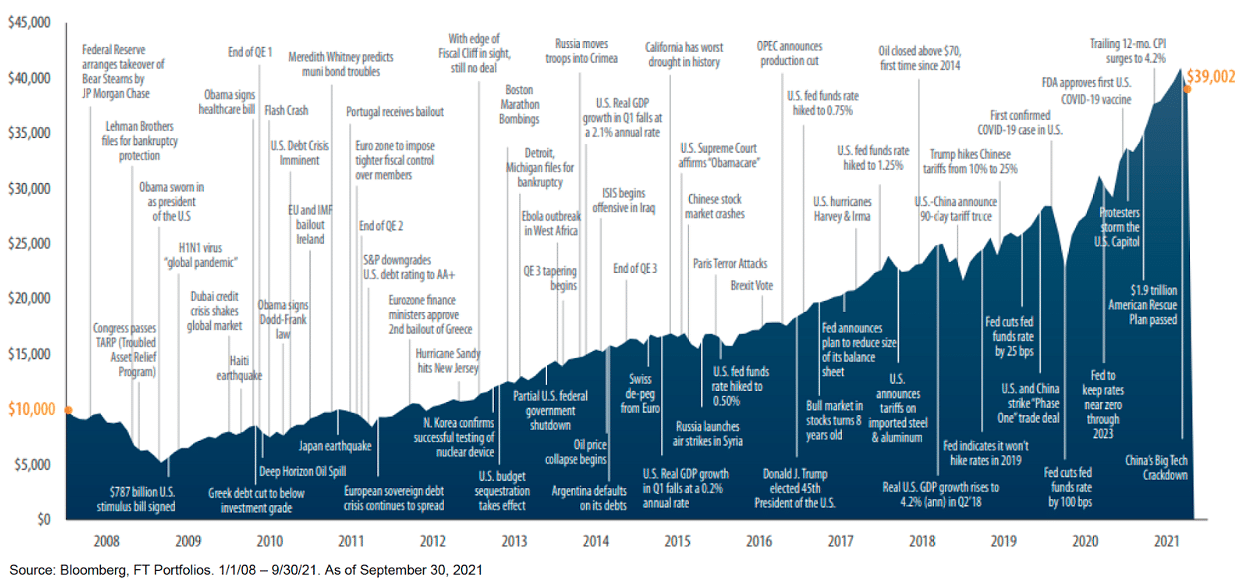

Stocks have gone through large global headlines and the “wall of worry”.

This is just since 2008, the market has been climbing the wall of worry for a lot longer. We will always be worried about the current thing until we forget about it and worry about the next current thing.

Stocks go up as the businesses that issue those shares produce more earnings on a per share basis.

As the saying goes “stocks follow earnings”. I believe the correct more modern approach to this is stocks follow free cash flow per share.

“Occasionally, people lose track of the fact that in the long run, shares can’t do much better than the companies that issue them.” Howard Marks