Braden Dennis owns 20 stocks.

They all have KPIs that move the needle for their business. They provide signal in a world of noise.

Here is the list and just one important KPI that he tracks for each one:

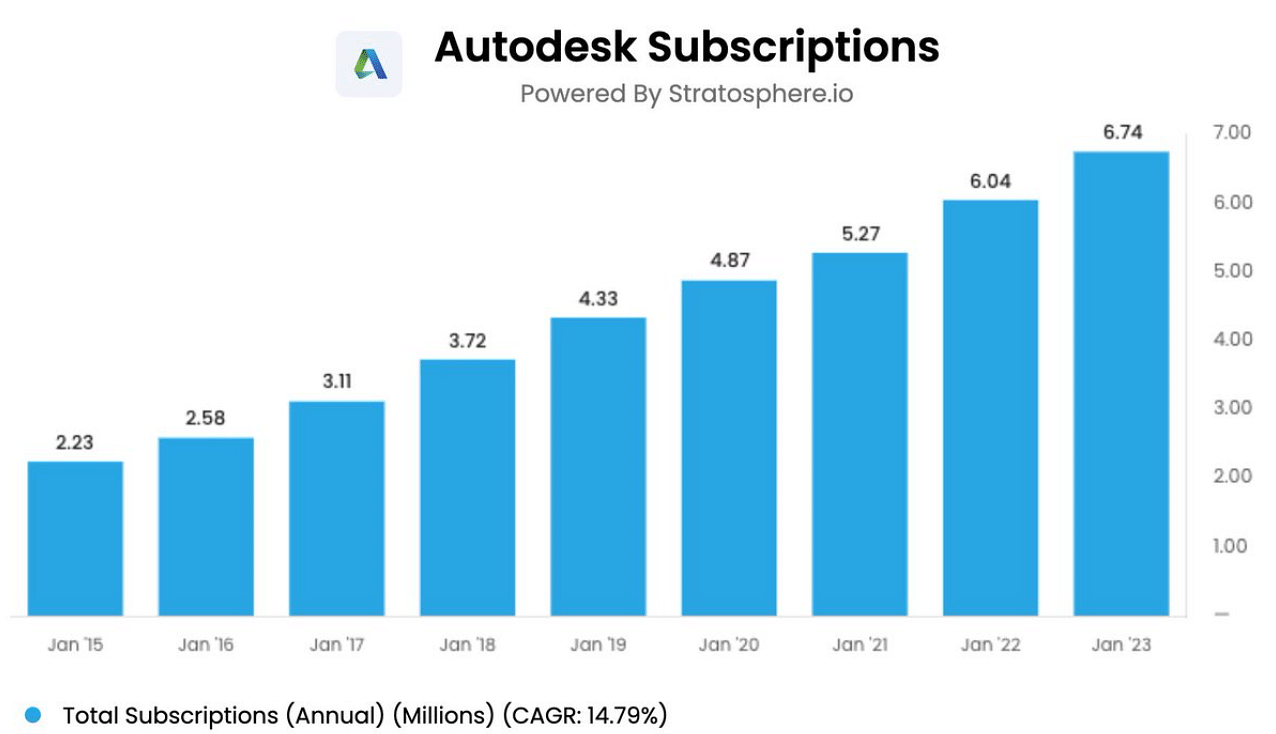

1. Autodesk $ADSK

Autodesk provides 3D design, engineering, and entertainment software and services worldwide.

Autodesk Subscriptions count gives me an idea how the business is growing customer base and recurring revenue.

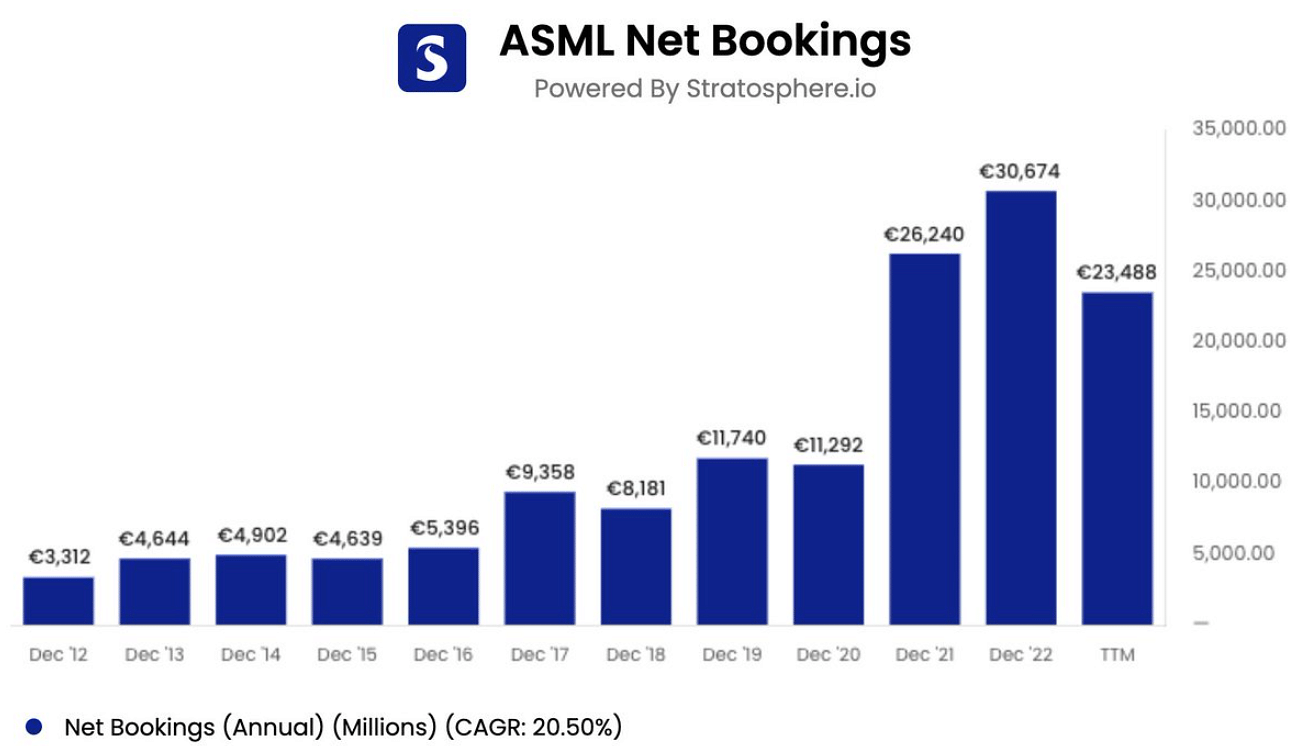

2. ASML $ASML

ASML develops, produces, markets, sells, and services advanced semiconductor equipment systems consisting of lithography, metrology, and inspection related systems for memory and logic chipmakers.

ASML's Net Bookings to track demand for their equipment.

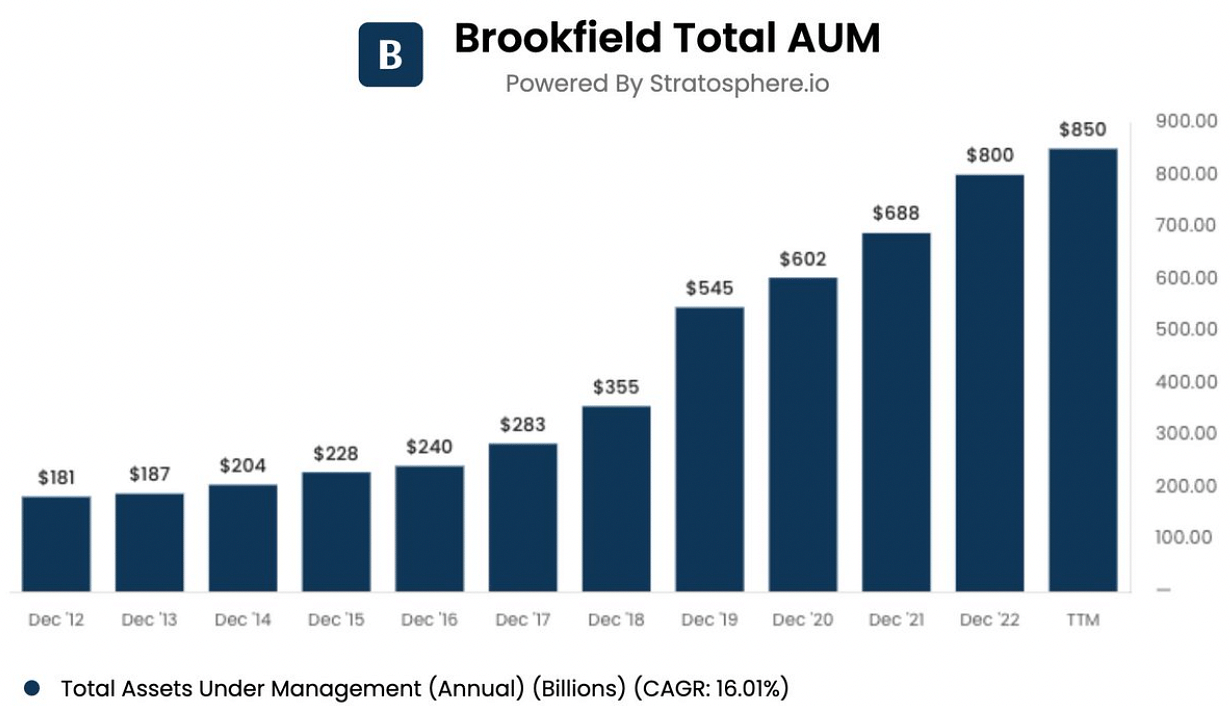

3. Brookfield $BN $BAM

A global alternative asset manager of infrastructure, real estate, renewable energy and more.

I track Total AUM (and fee-bearing capital) to understand the growth of the portfolio they operate and generate management fees from.

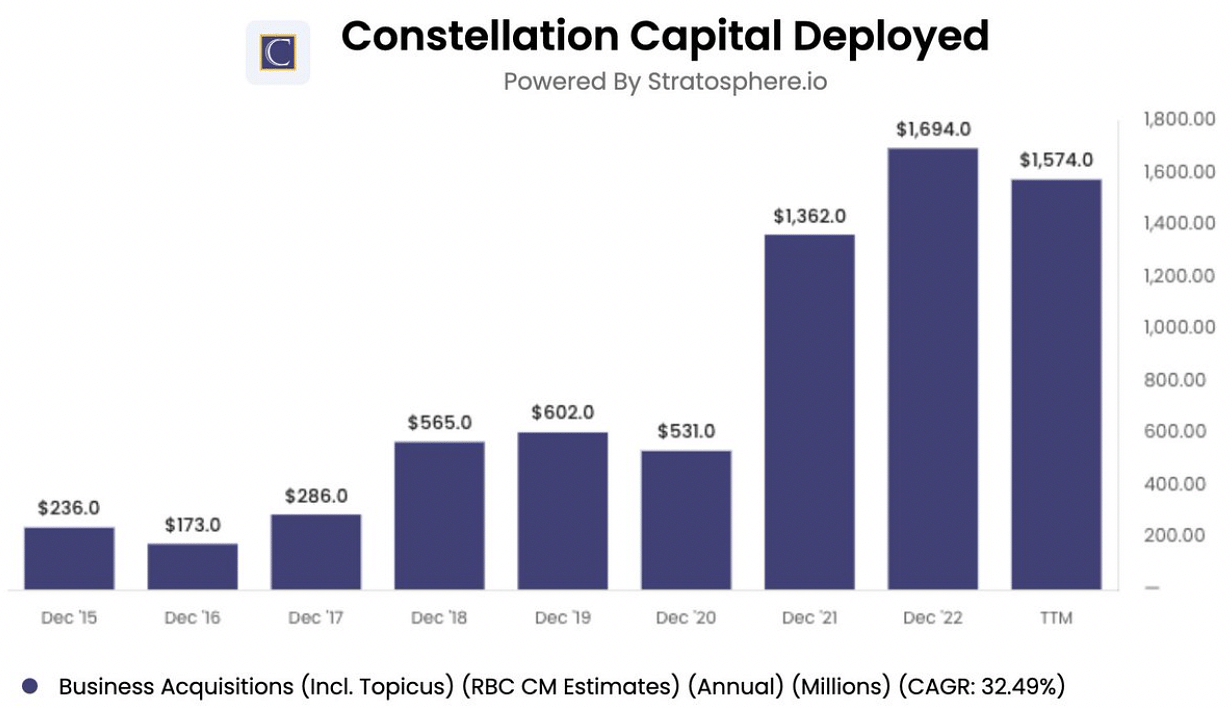

4. Constellation Software $CSU.TO

Constellation is a permanent acquirer of niche vertical market software companies. They own hundreds (soon thousands) of businesses.

Capital spent on acquisitions helps me understand if they are consistently increasing the pace of deals.

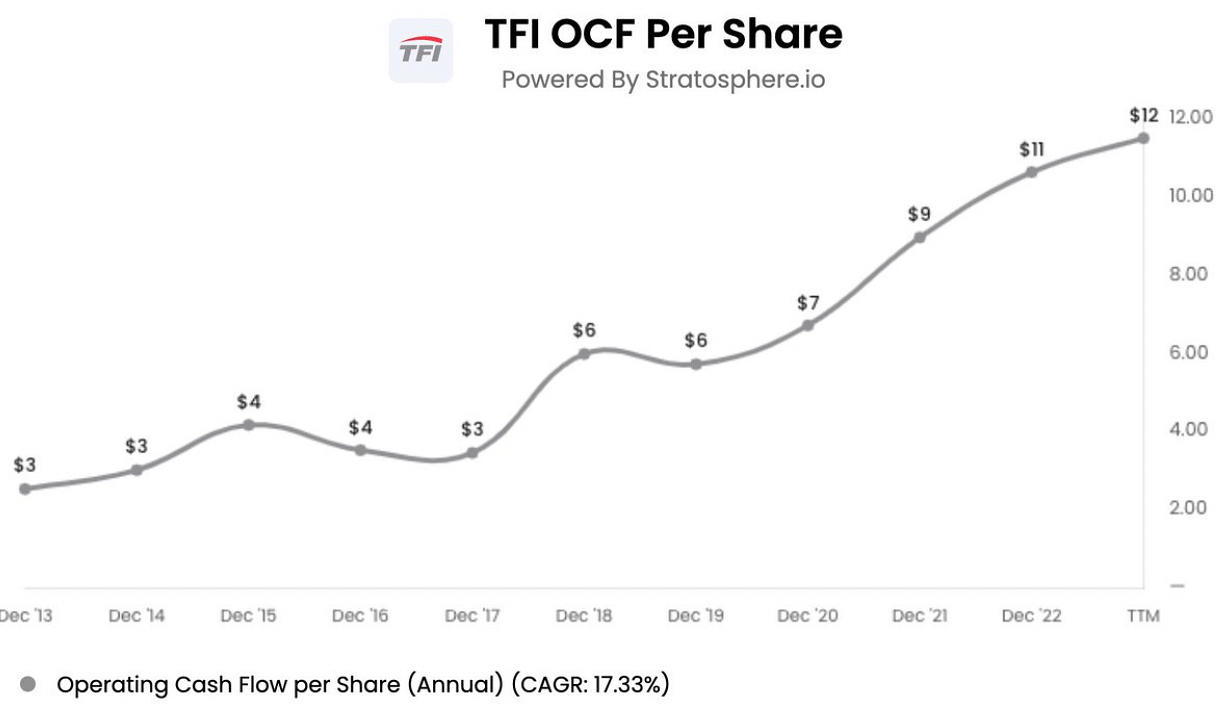

5. TFI International $TFII

TFI is a North American trucking company that typically acquires and integrates distressed trucking assets.

Operating Cash Flow per share (or EBIT by segment) to understand the growth of cash flows per share as they acquire, cut costs and buy stock.

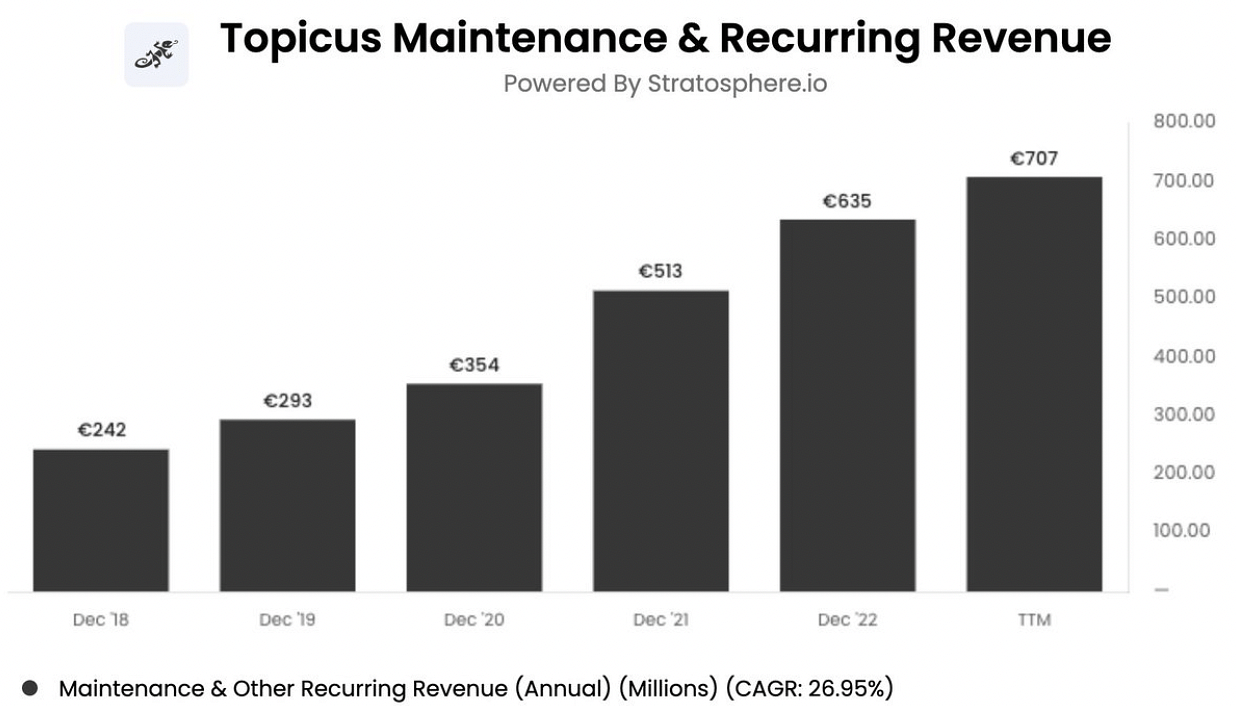

6. Topicus $TOI

A spin-off of Constellation software, Topicus is a permanent acquirer of niche vertical market software companies.

The maintenance & recurring segment is the bulk of their revenues and gives a clear picture to how ARR is growing across the portfolio.

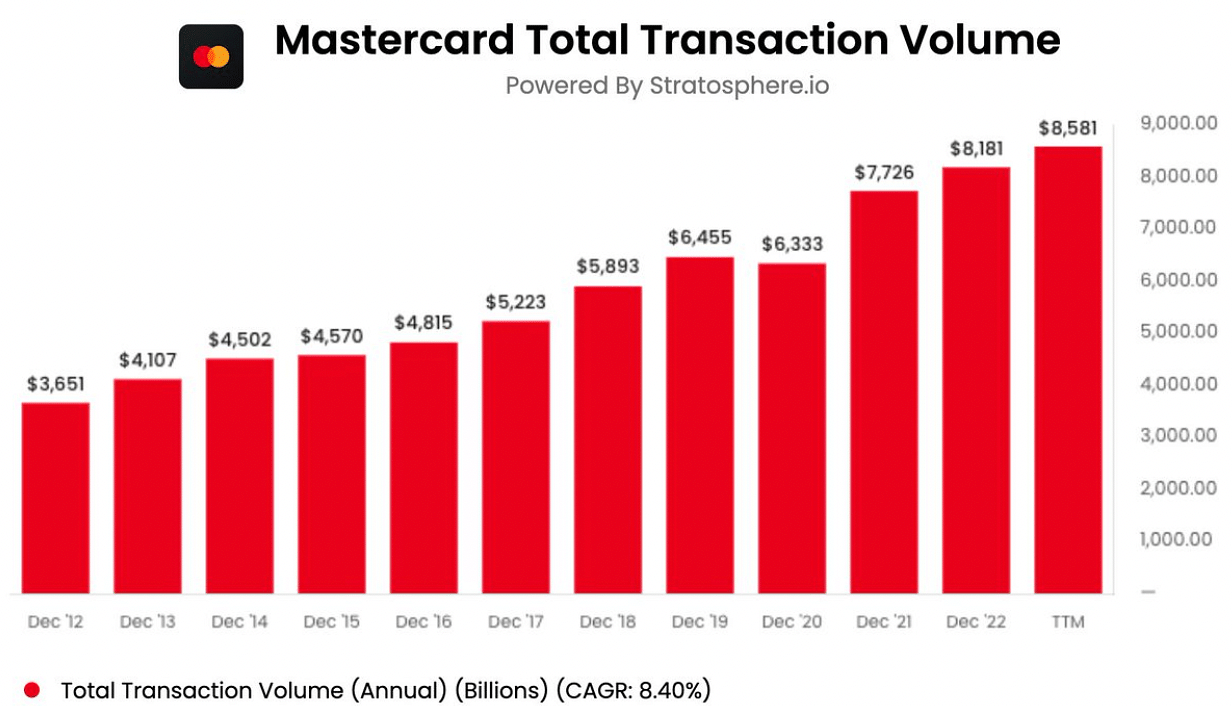

7. Mastercard $MA

One of the world's premiere payments companies, Mastercard facilitates transaction processing on their network.

In the trillions, total transaction volume gives investors a look into the growth of payments over the network.

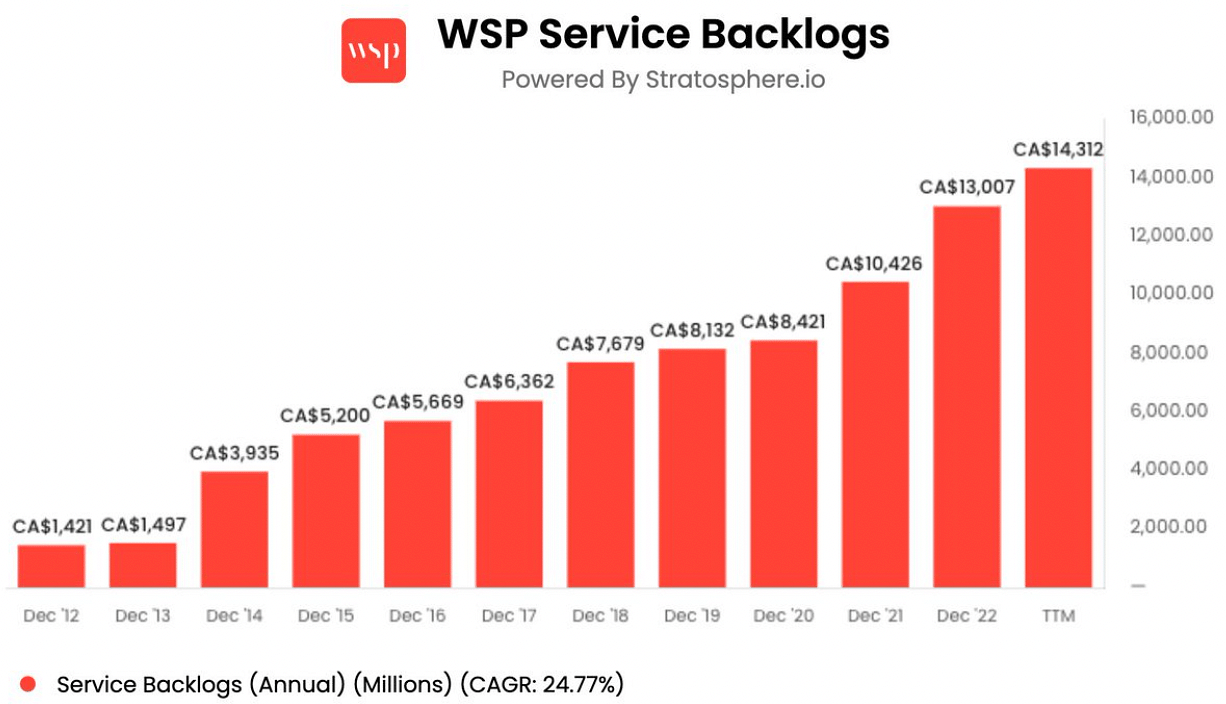

8. WSP Global $WSP

The Canadian engineering giant has become one of the world's largest civil engineering firms.

Service Backlogs gives investors a look into WSP's pipeline of projects they have won and will be completing and be revenue in the future.

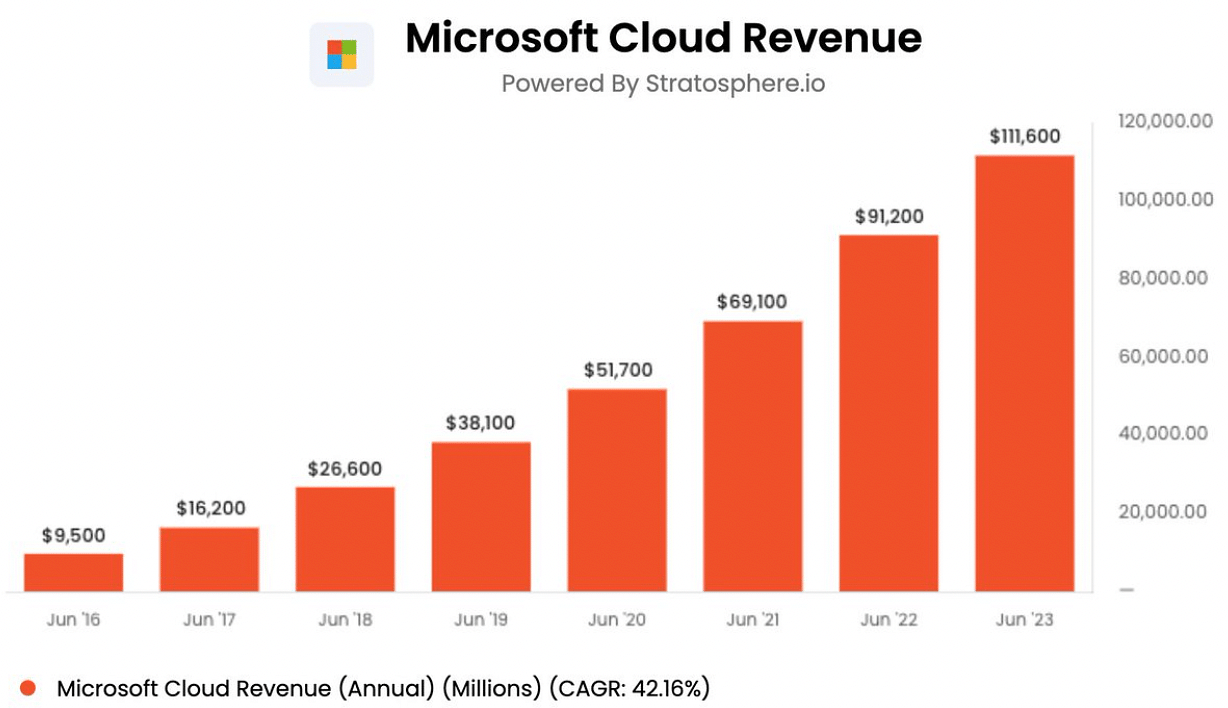

9. Microsoft $MSFT

A household name, but in just a few years under Satya Nadella, Microsoft has made huge advancements in cloud, AI, gaming, and the developer ecosystem with Github.

Total Cloud Revenue brings in many of those different services into one line item.

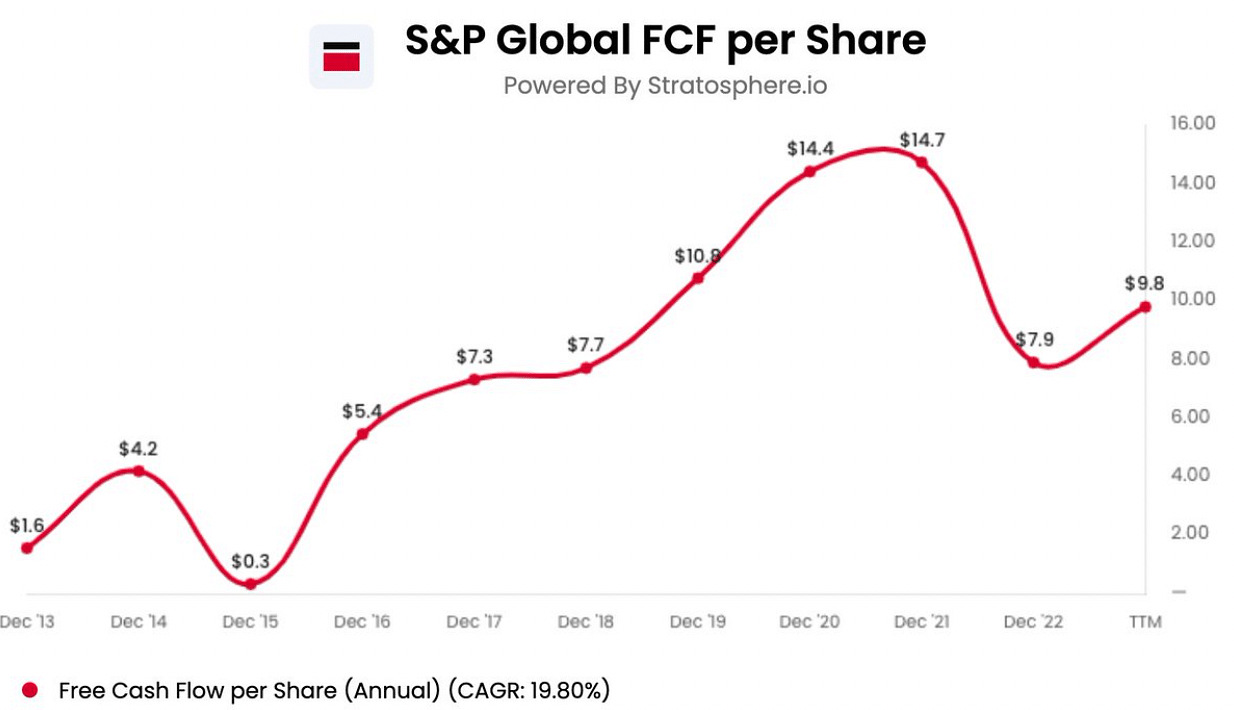

10. S&P Global $SPGI

Across their divisions, S&P serves the financial markets with credit ratings, data, indices and more.

Through mergers, segment changes and its multiple subsidiaries, Free Cash Flow per share when in doubt is finance nirvana.

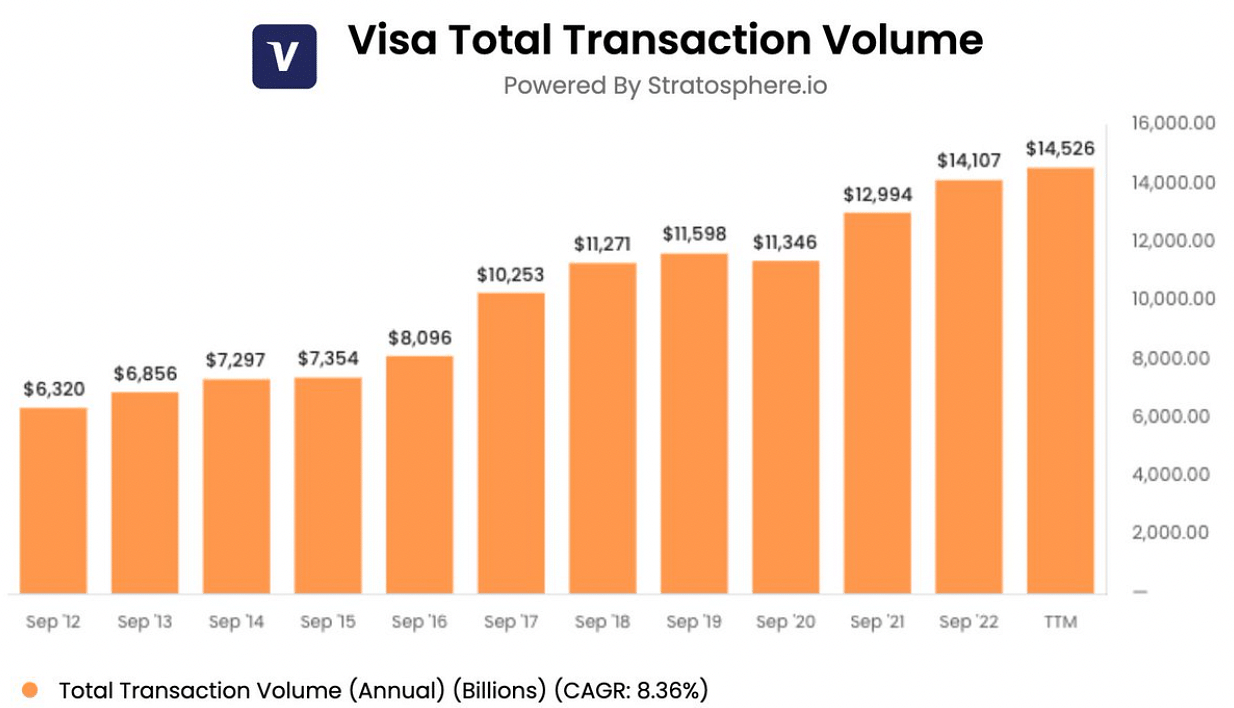

11. Visa $V

One of the world's premiere payments companies, Visa facilitates transaction processing on their network.

In the trillions, total transaction volume gives investors a look into the growth of payments over the network.

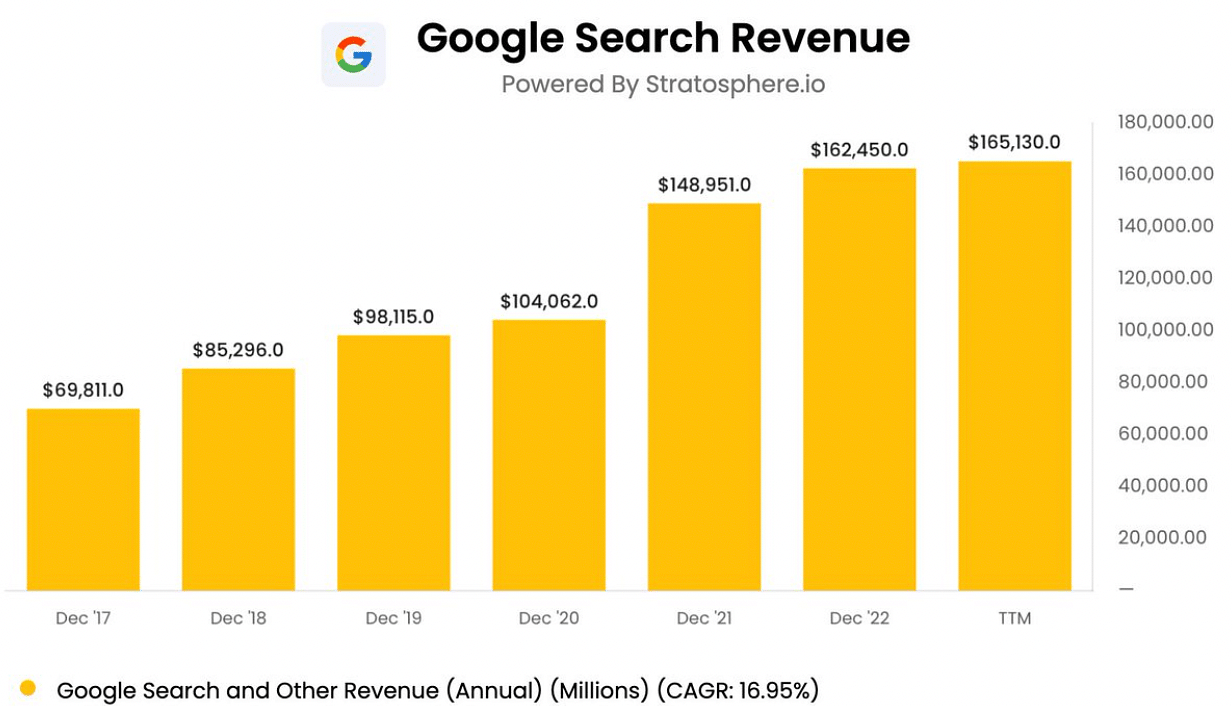

12. Alphabet (Google) $GOOG

For now, with little signs of budging, the king of Search.

Alphabet is also home to G Suite, YouTube, Google Cloud, and more.

Producing $165B in revenue, the Search Business is still on top.

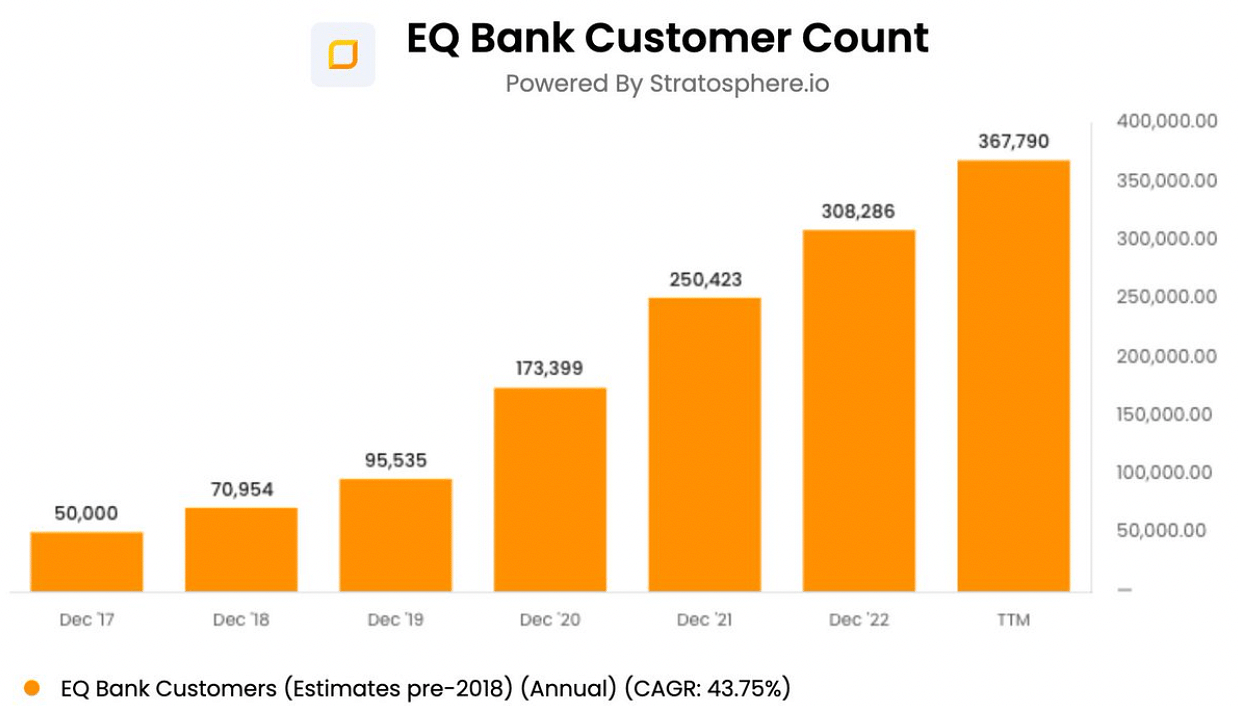

13. Equitable Group $EQB

A lender and owner of fast-growing branchless Canadian bank, EQ Bank, Equitable stock has been the best performing North American bank in recent years.

Tracking AUM and deposits is cool.

But, EQ Bank even discloses their explosive customer count.

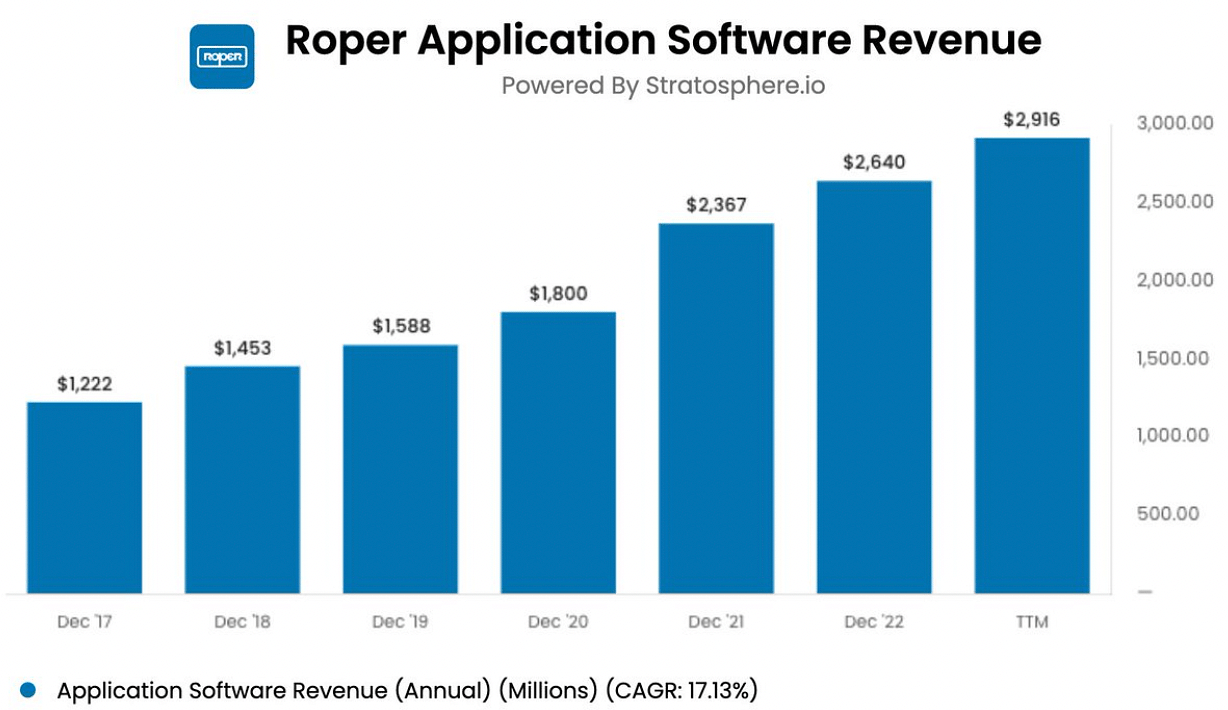

14. Roper Technologies $ROP

Roper is a conglomerate and acquirer of diversified technology businesses.

Roper has seen a tremendous pivot to software under the current management team.

Now the largest segment, the Application Software portfolio is driving Roper's growth.

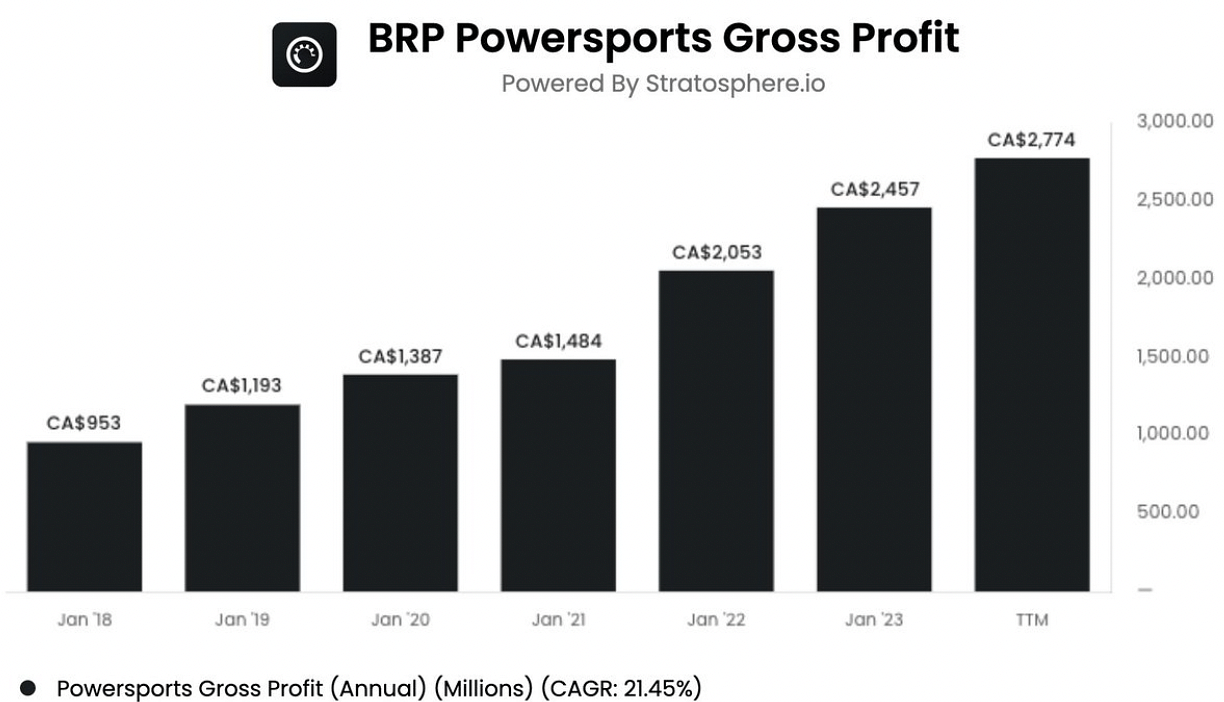

15. BRP $DOOO

Designs, develops, manufactures, and sells recreational vehicles.

With key brands Sea-Doo and Ski-Doo, BRP is a leader in the Powersports market.

Sporting double digits growth and buying back stock hand over fist, the brands have been gaining share.

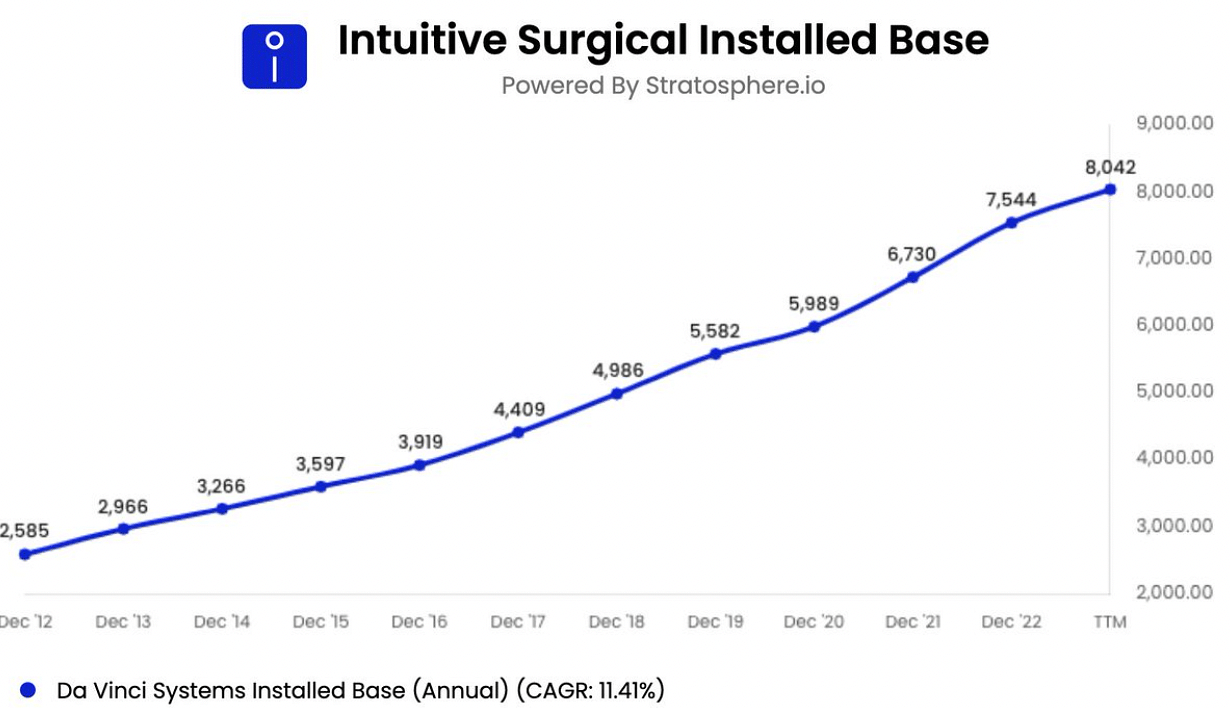

16. Intuitive Surgical $ISRG

A leader in robotic assisted surgery systems, Intuitive operates a true razor and blades model.

Once their systems are installed, they make ongoing sticky recurring high margin revenue.

I track their installed base of surgical systems.

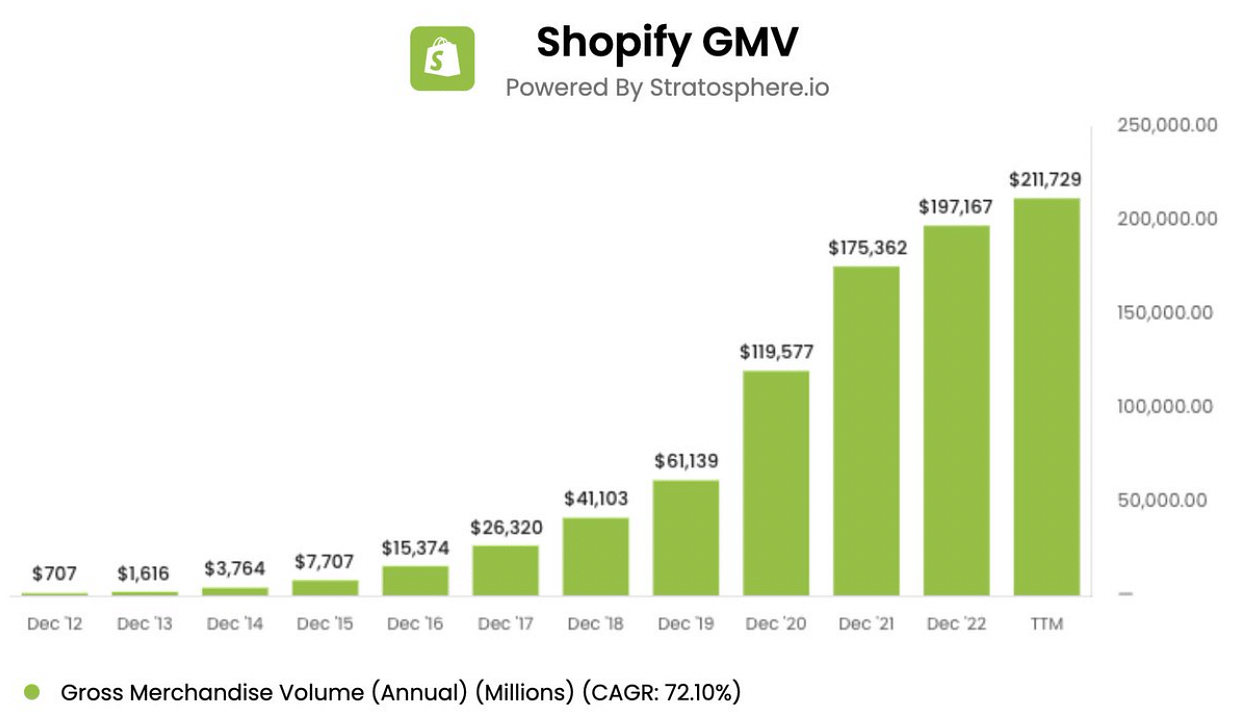

17. Shopify $SHOP

The e-commerce platform that lets merchants sell their products online. Shopify works with businesses large and small who leverage their infrastructure to do business online.

Shopify's Gross Merchandise Volume has exploded from $700 Million to $211 Billion.

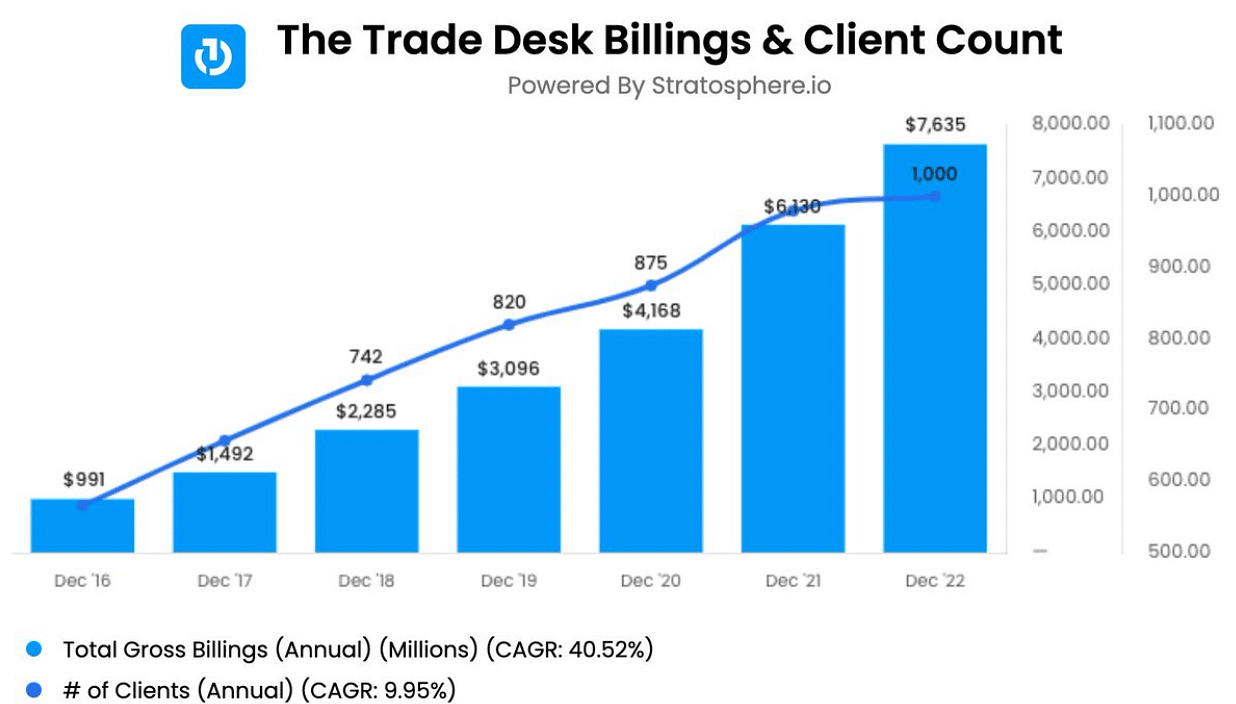

18. The Trade Desk $TTD

The Trade Desk is a demand side platform for advertisers to reach customers across any platform, any time. TTD helps advertisers optimize ad dollars with big data.

The business has seen monster growth in total billings and customers who use the platform

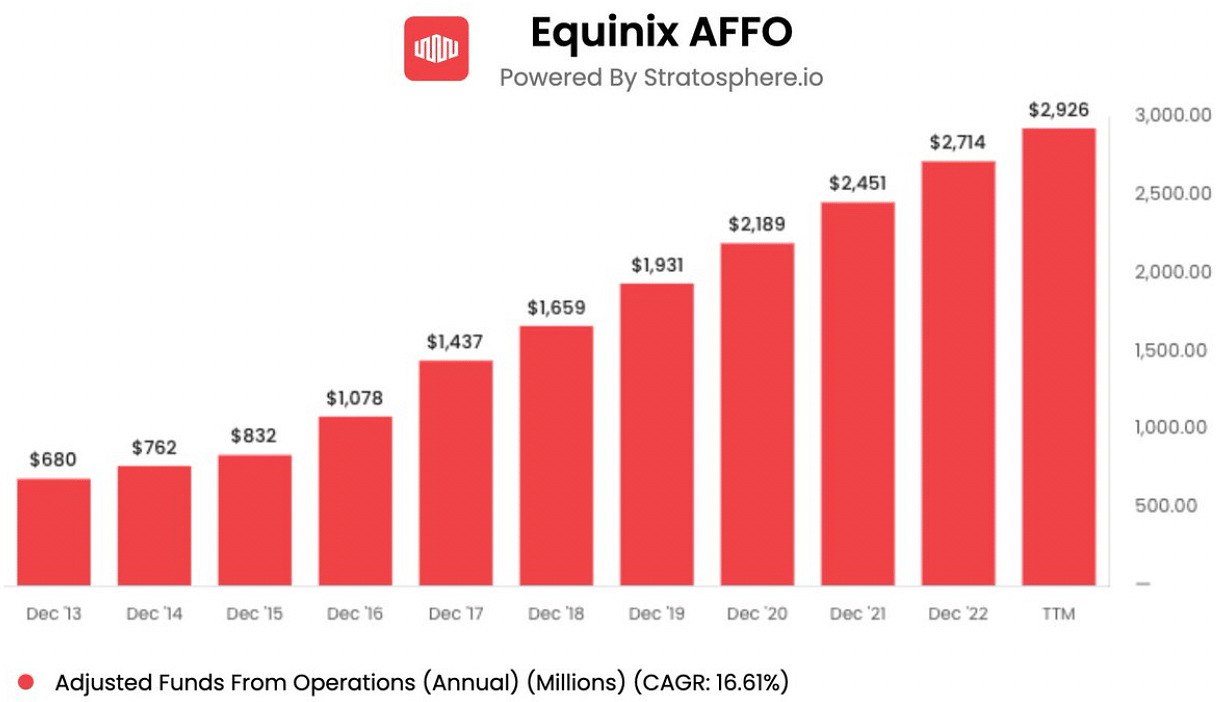

19. Equinix $EQIX

Equinix is a real estate and tech infrastructure company that operates data centers all around the world.

They operate 250 data centers and over 450,000 interconnections.

Adjusted Funds from Operations (AFFO) is the most useful way to measure profitability.

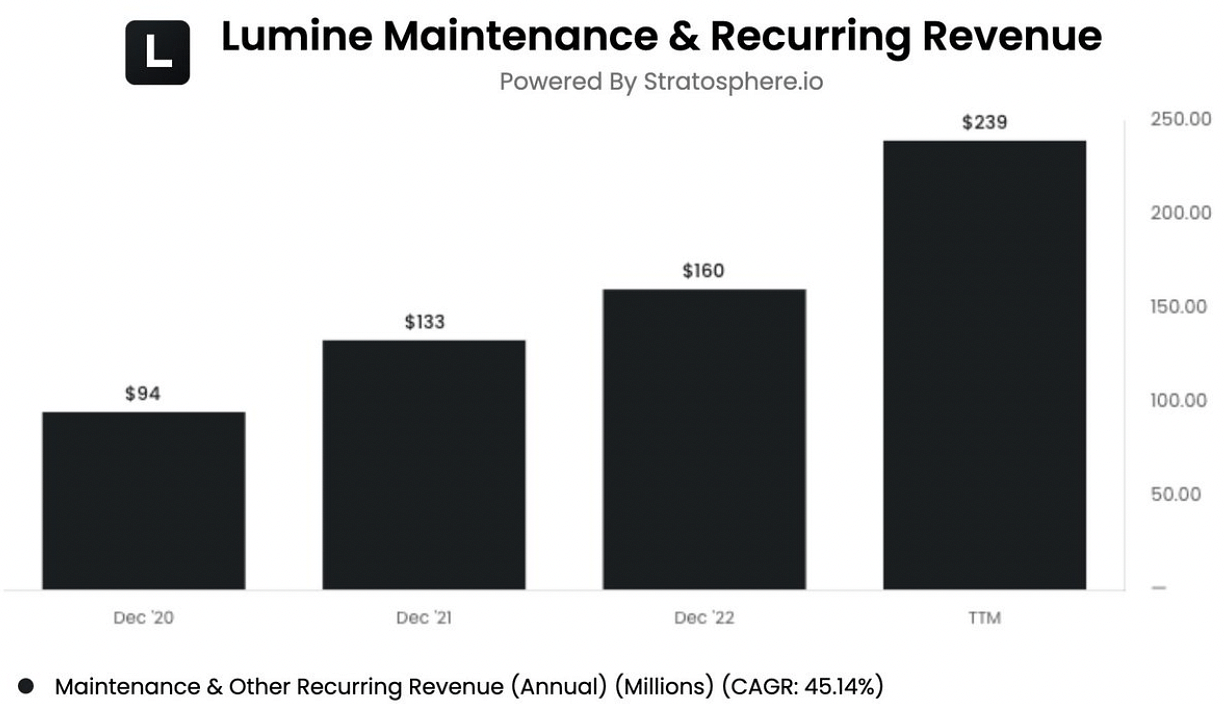

20. Lumine Group

A spin-off of Constellation software, Topicus is a permanent acquirer of niche vertical market software companies.

The maintenance & recurring segment is the bulk of their revenues and gives a clear picture to how ARR is growing across the portfolio.

That's all of them.

Sometimes I track several important KPIs for each position.

I keep it simple and focus on what matters to the business and NOT the stock price movements.

Each one of these companies have every KPI & revenue segments tracked on .

You can see the whole list along with the breakdown on Jointci.com.

You can also see the full podcast episodes and Braden and Simons portfolios on jointci.com.